- lazy girl capital

- Posts

- How Eshita Kabra-Davies Built the Largest Shared Wardrobe Worth Over $70M

How Eshita Kabra-Davies Built the Largest Shared Wardrobe Worth Over $70M

Sarees Never Had Blouses | Friend Net Worth > Net Worth

@pesalamapodcast Day 2 of 75 days of culture: Saree blouses, modesty and "tradition". We used to dress for the ☀️ weather… #fyp #foryou #foryoupage #fypppp... See more

In the spirit of interviewing a South Asian founder, I wanted to yet again call out how much colonialism has ruined indigenous cultures around the world. Western countries were like we like to know (LTK) how to cover up women’s bodies, so we can maintain a power dynamic. Nothing about a saree blouse is traditional. Why can’t we just stay in our own lanes and respect who we are at the root? Another reason why we all need to read more instead of figuring out how to find the best dupe for the Coach Brooklyn bag or finding a new conversation starter piece (okay, this fortune cookie necklace is going to help me manifest and stand out in rooms)

@c.a.i.t.l.y.n today i talk about the whole foods berry chantilly cake debacle, marx’s falling rate of profit, and why we can’t have nice things #leftis... See more

I’ve been thinking a lot more about this concept of community interrupting routine. Again, so western and capitalistic in nature. We should be able to have community and the Whole Food Berry Chantilly Cake with fresh berries not berry jam! But, capitalism ruins it all. We are one for ourselves and even if a company has strong profits it has to increasing in profits YoY…So many other corporation and even later stage companies change the recopies of their products to improve “efficiency” and as a result ruin customer experience.

If there’s one thing we should invest in, it should be community. We should cook together, eat together, do chores together, read together, pick each other up from the airport, and live together. But everything comes back to increasing your net worth instead of your “friend net worth.”

Eshita Kabra-Davies requires no intro. This has by far been my favorite interview I have done to date.

What have you realized is worth waiting for recently?

Scuba diving! And then one day exploring the Mariana Trench. I want to do more wildlife adventures a la The Wild Thornberrys…

Have you had a moment where you're like, "Oh, this is why I want to be a founder and continue to be a founder"?

I have realized more and more over the last five years of running this company that this is my calling. I feel very much like I've met my match. One of the things that my friends and my husband would joke about me before I founded By Rotation was like, "You have so much energy, determination, and enthusiasm where do we put that energy? I think for me, By Rotation has been that avenue.

I grew up in an entrepreneurial household. Back in the day, being an entrepreneur wasn't as glamorous. It was kind of a way to make it on your own if large organizations wouldn't really hire someone who looks like you, or maybe you lack the qualifications. You have the opportunity to forge your own path. But these days, obviously, being an entrepreneur is like, "Oh, I'm a founder, I'm a visionary, I don't need to turn a profit. I just need to make sure I can raise the next venture round."

My dad, who has a rags to riches story, would inspire us every weekend. He would teach us what he called life learning skills. We learned how to be more street smart, how to have the upper hand in a negotiation, how to network - stuff you don't learn in school or higher education. It was based on actual experience. All of that comes back to me now.

I completely agree that you can learn how to be a better leader. But I do feel that leadership, being the actual leader of an entity, being right at the top as a leader - part of that is innate. I don't think everyone can be a good leader. I think you really have to have it in you, and part of the ingredients are courage. Courage is a big one. I don't think it's confidence, it's actually courage and tenacity. When things are fine, anyone can be a leader, it's when things are tough that you really know if you are an effective leader.

I've finally found an application for all these things I had in me - the energy, skill set, courage, and tenacity.

You recently posted about the founder mode. Are there one or two takeaways that you felt strongly about that you can speak to in relation to your founder journey?

Definitely "not quit". We're seeing a lot of quiet quitting happening. And it's really unfortunate when founders start to check out. I think maybe because female founders tend to be so much more vocal on social media circles, you're seeing it more where they're losing interest in their business and not really engaging with it anymore, especially when times get tough, which has been the last one and a half years.

They've all been quite vocal about how challenging it's been to build the business and being upset with the system, which I agree is completely unfair. But the reality is, that is what building a successful business is about. It's about sailing through the storm and actually coming out being stronger than ever. When you quit during these moments, I'm not sure that you're actually an effective founder and leader that a company at a very early stage requires.

For me, grit and not quitting, is super important. All those cheesy sayings you hear growing up like "when the going gets tough, the tough gets going" and "what doesn't kill you makes you stronger" - I actually very much believe in that. It's not because I have an aggressive personality or I'm an alpha female, but I've actually seen that each time we survived any kind of major issues in our operations, such as the pandemic or having a terrible fundraising environment, it actually made us much more resilient and made us go back to the drawing board and reconsider what we were doing and remind us of our mission and our vision.

Another point I feel I do quite a good job at is wearing hats that I know I'm that I'm strong at, and then delegating tasks that I know I'm not good at. I can do them; I can get by. I've built the business doing every single thing, especially in the early days - I'll do customer service, I'll go to the post office, I'll speak to journalists, I'll fundraise, I'll do everything, I'll do social media. But there are quite a few things that I'm not really that great at, and that's why I hired people who are better than me to do them.

I think that's super important, knowing your strengths and weaknesses and hiring for the gaps and actually giving people who are better than you at them liberty to go and improve what's already existing. I think doing a SWOT analysis on yourself is super important. You have to be able to see quite clearly and be like, "Yeah, I'm really bad at this. I don't think I should do this. It would not be good for the entire organization." Having that clarity is so important.

Did you have a moment when you realized, "I'm not good at this and I need to really hire someone"?

Oh, all the time. Like, I often will be like, "Okay, I really don't feel comfortable doing all these 'get ready with me' videos or 'let me show you a day in the life of'." And I'm like, you know what, I don't want to go viral. I don't want to be the person who has to go viral for my business. I'd rather the community do the talking or hire someone in social media who's very happy to make all these reels and content and talk about the latest trends on TikTok or whatever. That's not for me. So, I'd say I have a pretty good awareness of who I am and who I'm not. And that helps me be an effective leader who's honest with myself and with my team.

How did you think through fundraising for By Rotation? How were you doing due diligence on investors and how did you figure out who would be a good partner to have on your cap table?

It's worth mentioning, my background was as a public market’s investor, so I have a pretty good idea of concepts like investment thesis, short-term trends, and the fundamentals of investing. Obviously, I was looking more at public markets, so it's a different space of investment. Private markets of venture capital are so much opaquer, which is where all these biases really come into play.

The Warm Intro: The concept of warm intro is so important. And it's so annoying, as someone who's an immigrant, who's a woman, who's a person of color - these things don't really work for me, because most venture capital money is being allocated by white males, right? And they're mostly in the US as well. They're not really in the UK or Europe, especially when it comes to consumer tech.

Diligence an Investor’s True Thesis: I think for me, I really just mapped out who actually invests in my specific sector in my geography and who's maybe talking about investing in women and diverse founders. I would still talk to the ones even who don't talk about it, because a lot of times it does tend to be lip service. They're kind of doing it to make themselves look good. And actually, the ones who are my largest shareholders, nowhere does it say that they particularly invest in women or people of color or diverse founders or whatever.

I actually like that, because it’s like, "We love consumer stories, we want to be in consumer tech and marketplaces and consumer brands, but we want to be in really, really good ones that are changing the entire conversation that's happening around the industry or their sector." For them, it's less about ticking boxes. It's more about, do you have amazing numbers and are you actually changing the industry that you're operating in completely for good, shifting it altogether, you're like shifting the curve, as they say, the macroeconomic curve.

Investors that are In It Till the End: That is something that I really appreciate and looked out for in an investor. Tom in particular, who sits on my board and is our lead investor, he's also a founder himself, he founded his own VC. He also used to invest in public markets, so we have very similar approaches to investing and thinking about investments, which is that it's not just about the next round of funding, that's not your exit as an investor in my business. You should be here until the end when we have the final exit. It's really all about long-term fundamentals rather than a big buck in speed grocery delivery or femtech AI or whatever.

So yeah, I think I was quite careful about who I took on my cap table, which is why to date, despite the standoffs that we hear between founders and founding teams and investors because of the poor funding environment, I've actually had a very good experience with my board and my stakeholders. We have a lot of respect for each other, and they see how By Rotation is really changing the conversations around consumption altogether.

Master of Your Own Destiny: The other thing, obviously, the more practical tip here, I'd say, is because we have such a large shareholding as a team within the business. There's not really much they can do to control me. And that's where I'm kind of the master of my own destiny. And as is my team; my investors can't make me do things that benefit just them and their investment, right? I will obviously always put my company first. My company and my team, I would always put them first before the investment.

Do you have advice on how to think about structuring your cap table and maintaining equity for founders who don't have a finance background?

Mapping Out the Funding Journey of Later Stage Companies: One of things I did was look at other companies' funding journeys. You couldn't find too much information, because again, it's so early stage, and a lot of them, if you don't go public, you'll never get any information on them. But I remember I was looking at Depop's funding journey, and I was seeing which years they fundraised, how much they fundraised each time, their potential valuations at each round, and how much ownership founders were typically giving up at the seed and series A.

Then, I would think in terms of their revenue growth, and how much more money they need for new rounds. It's probably worthwhile looking at companies similar to you that are three to four years older than you and seeing what their journey has been. But again, because there's been a complete shift in the last one and a half years, valuations have slashed. So maybe just be mindful of that.

Be Protective of Your Company: Besides not giving up too much equity to your investors in the first few rounds, you should not be giving board advisors, non-executive advisors, consultants equity. I've had a few early-stage founders offer me equity for advisory positions when the business hasn't even launched yet and they're like "Yeah we can't pay you like a consulting fee, but we'd love to offer you equity." I would advise against that because you don't know where the company could go. You could have amazing funding rounds and exits and then the investors who want to come on board might be like "Why did you give this person one percent? Who's this person? Who's that person?" But this person's company went bust or they've been tried for fraud or something - who knows, right? Who knows what happens to people?

I think just be really, really cautious about giving up equity just because you think "Oh well I don't need to pay this person a consulting fee, isn't that great?" I think that reflects better on you as an early-stage founder as well because it shows how protective you are about the company. You're like "I really, really value your skills, your advice. I can't give you equity because the company is very valuable to me and it's going to be so huge, so we're willing to pay you this fee."

How are you thinking about your personal brand in relation to By Rotation?

No Key Woman or Man Risk: I like to think that it hasn't been strategic and I'm just very particular and therefore it seems like it's been strategic. I have high standards professionally but also personally and that's where you can probably see I am very careful about where I speak. I'm very careful about which articles I'm happy to be quoted in and I think that's really a reflection of the By Rotation brand as well.

The By Rotation woman is pragmatic, she is discerning, she doesn't really shop that much anymore but when she does, she's buying investment pieces that she's renting out to others, so I think it's really important to build those sorts of high standards within the platform which is our service.

Because I'm not a product founder, I don't have a tangible item, I'm not selling you a fashion brand or makeup. You see a lot of founders in makeup and fashion, they really show up for the brand all the time, they have to do the "get ready with me" video, it makes sense for them. I mean, I could also do that, I could always show you these amazing deals that are happening on By Rotation. But our focus as a social network first type app is really to showcase our community. I think that's where the power is.

This also ensures that there's no key man or key woman risk. This is how I can actually have a more balanced summer; I can go on holiday. And it shows that without me, the business is still flying. It's not all about me.

Focusing on the Long Game: I really care about the long game, and I think with social media, people are so destined to have things right now. They want to have a large following, they want to have lots of likes, want to be invited to all the right parties and events, because then they can talk about their product or their service. I think for me, maybe it's a cultural thing, maybe it's an age thing. I want to make sure that the relevance around By Rotation and me isn't just for this five-year period. This is something that needs to live and grow forever, so I don't feel like I need to jump on trends. I'd rather do things that actually make sense to me.

I wouldn't like to sell out just to be the person of the moment. And you see quite a lot of founders having to go through that, and then they have to join the next thing, and the next thing, and the next thing. You know, one day they're at every single party. And then the next day they're talking about manifesting and what’s in and out. And the next day they're crying about how 2024 has been a disaster. Then, in 2025, here are my new year's resolutions.

Don’t Dilute Your Brand Equity: Maybe it comes with age. I feel mentally a bit older. I’m married. I used to work in finance. I do feel conscious about what I post on my public social media because I used to work with very high-profile people who are very clever and intellectual. Some of the stuff I see online, I'm like, this is a bit embarrassing. And I wouldn't want my ex-colleagues to be like, "Eshita, what are you doing with our money? Like we invested in you and now you're crying on camera about burnout, like what's going on?"

I think a lot of people are chasing that hype, that moment, and wanting to be relevant. But they're forgetting about the fact that some of these things are not appropriate, and they shouldn't be said online. My way of building my personal brand is subtle. It's one that's meant to last for a long time. My personal brand is to be an expert in the sharing economy and to keep that forever, not just for five years of By Rotation.

To date, what have you been most proud of that has come out of By Rotation?

We've built the world's largest shared wardrobe. We've got over 150,000 peer-to-peer listings in the UK and the US. We've done that with very limited funding, and we've done that through the pandemic. It's been crazy because these items are worth $70 million - the largest shardrobe!

We've got incredible pieces. We had a feature recently in the Times newspaper about how you can rent Birkins on the By Rotation app. You don't even need to be invited to buy them! We've removed the exclusivity and made it possible and affordable. We’re democratizing fashion.

You can also find really rare Fendi croissant bags or vintage Jean Paul Gaultier. So yes, sometimes, it's not even about money: it's really about finding those crazy unique rare pieces or having access to things that money just can't buy.

Are there any stories that have stood out to you of how By Rotation users have used the platform?

We had this woman who told us that she left a full-time job after having her second child, to rent out items on By Rotation full-time, because she was making more money by renting out her frocks and other clothes than by commuting to work and also paying for childcare for her two children. It actually gave her the flexibility to be an entrepreneur and spend more time with her young kids at home, and be more present, which was amazing - so much female empowerment, financial empowerment, being individual, being an entrepreneur.

Then we've got a woman who's saving up for her home deposit by renting out her clothes, which is also amazing.

And then this is less related to money, but it really stands out. So, I don't know if you know, like when you get married there's like something blue, something borrowed, something old. The modern take to something borrowed, which we've been seeing in the UK a lot, and we've had a couple of cases in the US as well, is brides renting for their wedding from By Rotation. In particular, this happened I think a few months ago, so early in the summer or in spring, a woman rented her actual wedding gown from another woman for her wedding day and even delivered it with a slice of her wedding cake.

What do you think it will take for people to continue to rent out their wedding dresses or guest dresses?

For weddings, it needs to become mainstream. We’ve had a lot of success in the UK because a lot of celebrities and influencers have adopted By Rotation just very early on seamlessly, you know, without asking for paid partnerships. They know that everyone's talking so much more about sustainability, and no one wants to be wasteful anymore. It's not cool to be wasteful, and it's not cool to be flashy.

When you see someone having five wedding outfits at an Indian wedding, people might be like, that was a bit much. How nice would it be to say that I rented them or I'm lending them out after my wedding? I think it kind of shows that you're giving back, you're much more conscious, and you're also being mindful that not everyone wants to spend this kind of crazy money.

We'll find out if the US isn't in a recession, but there's been a cost-of-living crisis happening in a lot of developed nations, even the UK. I think all of these factors have really helped people realize that renting for all these major events makes complete sense. It's not gross or icky or doesn't stick on like, oh, you don't have money or something. I do think maybe in more Asian countries and Middle Eastern countries, they're not fully ready yet. I think within the markets we operate in the US and UK; it's beginning to be seen as very cool, very mindful.

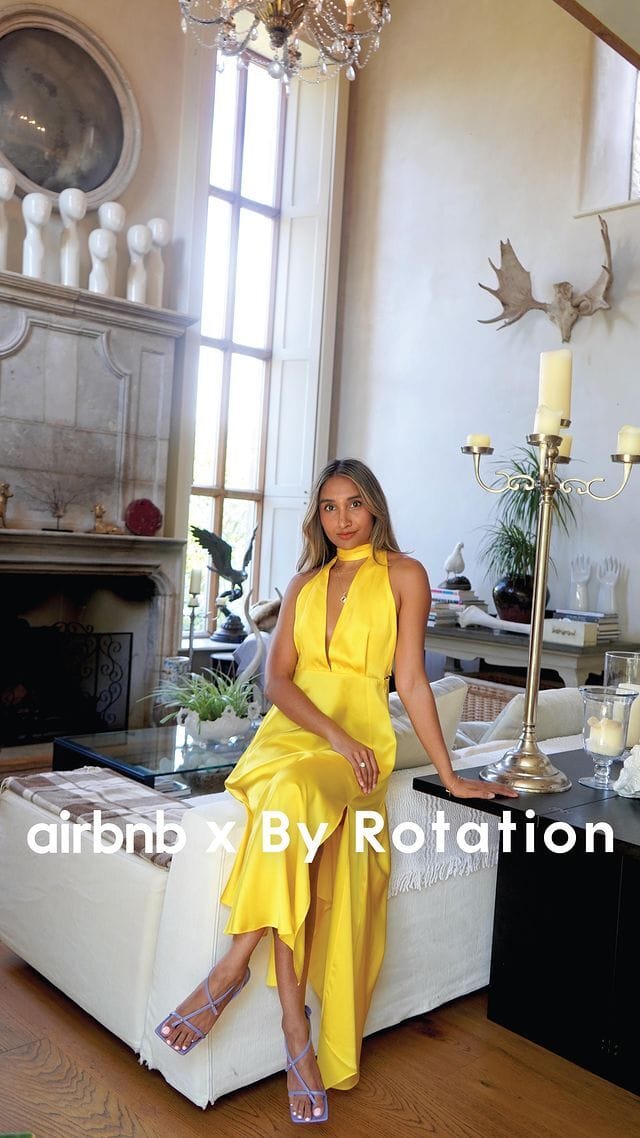

Can you walk me through a little bit of the Airbnb partnership? How did that brand partnership come to be?

We’ve been in touch with them for a few years, and I’ve always said that I would love to do something with you all. Let me know. So obviously, they're very busy. In 2022, they were just getting out of COVID and going back to normality.

So, in 2023, I was like I think we could have a chance because there's going to be a travel industry boom in 2024 and 2025, which we have seen. Finally, I felt like it was the year. They were ready to do more partnerships beyond the big ones that they did with Barbie last summer.

They approached us in the spring of this year. They're like, we're ready, we want to do something with you. And I was like, oh my God, I've been waiting for this email for the longest time. We said it would be great to do something over summer because obviously people are going on holidays and people rent during holidays. They're like, okay, we agree with you, it should be the summer, we shouldn't wait until festive season but let us regroup and think of what exactly the angle could be.

They regrouped, and they said they like the idea of destination weddings. Airbnb started seeing metrics and stats on their back end about groups of friends traveling together and splitting a villa for events such as destination weddings.

It's already a lot of money to go to your friend's wedding with the flights, paying for the villa, and also outfits, because obviously you want to dress nice in this destination. Hence why Airbnb proposed this angle for By Rotation. If you’re planning on attending a wedding UK, Ireland, Spain, Italy, France, North America, Scotland, Greece, or the Caribbean, you’ll receive a £150 By Rotation credit to rent your wedding outfit and £100 Airbnb credit for your next trip

We want to make it convenient, cost-effective to attend a wedding and any event. Similar to Airbnb, we want to be as much a part of the sharing economy as possible. They’ve been such a great partner, and the partnership will last until 31st December this year. We're just really, really happy, and I don't think this is going to be the only time we partner with them.

Have you personally angel invested in other companies?

I've been asked by a few people, but I really want to show to my investors that whatever additional capital I have, I'm putting back into the company. And the other thing is, you don't want to over-promise to people and be like, here's the very little money that I have that I'm going to put into your company, I'm going to do all these things for you. But wait, I'm also running a company. I think it's very interesting: it's one of those clout chasing things to be like, I'm the investor in this. It's social climbing.

And I don't want to be that person who gives you $1,000 and asks for a billion favors. And I wouldn't like that for myself either, which is what I meant when I said I'm very careful about who is on my cap table.

I don't want to be disingenuous when I say I'm an angel investor. I've seen some people say they're an angel investor just because they join like a crowdfunding round and put a $100 ticket? And I've done that back when I was 23 years old and started my first job, using CrowdCube and investing in interesting companies.

My focus will always first and foremost be By Rotation. You don't want your stakeholders, your investors, to think that you're distracted as well. It's probably something that is not what others are saying. I'm probably a bit contrarian!

Who's someone that you're currently obsessed with/inspired by who isn’t a founder or creator?

It's got to be my girlfriends who I just spent a few days in the south of France and in Milos. It's Jessica and Martha. I've known them before By Rotation. They've seen me grow, and they came to my wedding. One of them was my bridesmaid. They're huge champions of By Rotation and me, just like very staunch supporters.

They're my biggest champions. They would go to any important room and go like “Don't you know who she is? You must have heard of By Rotation. Well, that’s her company. She's Forbes 30 under 30. Did you know, she's one of the few women who’s raised venture capital?” They are basically my mouthpiece, you know, and I think it's so great because I often get told I am quite humble, but I couldn’t imagine being the other way!

So, they've been really really supportive throughout my journey, and I look at them and I think wow like obviously you're my ideal customer. But these are the women who are self-made women, who choose to work very hard in their corporate jobs and make an honest living while killing it. They're working hard, and they're playing hard.

I mean these are the kind of women that I really respect, who have such a great balance in their life. I think that's so important. You see everyone wanting to become a content creator. What is the end game? Are you doing it because everyone around you is doing it? What about having an actual job where sometimes you need to go into work? We’re seeing more and more of this whole quiet quitting culture. Where did the hard-working people go? Where did the self-made people go? Where are the people who actually want to use their brain and stimulate it from at least 7 a.m. to 7 p.m.?

I want to see more of those women again. I love high achieving women who are such great supporters of their friends and not threatened by them. They really inspire me. And I like to think that I hopefully belong in that circle too. There's nothing better than a woman who's very intelligent and achieves great balance in her life.

I’m so excited to announce that I’ll be launching a new anonymous interview series in the coming weeks!

As someone who’s had the opportunity to sit in the LP seat for the past eight months, I’ve learned how valuable having an angel track record can be for aspiring fund managers.

I want start creating more transparency around how to get started as an angel investor by asking other angels about their portfolios, SPV they led or participated in, how they got started (apart from getting accredited, how are you budgeting for this, do you have a partner that you do this with or other family members?), angel groups and resources they lean on, how they personally underwrote a deal, household income & total assets, and their long-term goals.

Wanna be besties?

Email me at [email protected]

Follow me on Linkedln

Follow me on Twitter

Follow me on Instagram