- lazy girl capital

- Posts

- The Brat and Demure Gal in Finance: Shreya Durbha

The Brat and Demure Gal in Finance: Shreya Durbha

24: my year to cosplay as an olympian

24 is the year I start my campaign to get invited to the 2028 LA Games. And no, that’s not me just being inspired after having walked in the same winery Sydney McLaughlin-Levrone got married in. I’m being very serious.

I went in with no expectations for my 24th, and I had one of least stressful birthdays this year. I usually cry on my birthday mostly cause I feel like I didn’t fulfill some grandiose goal (like not being able to compete in the Olympics lol) I had for myself. This year I did accomplish something I dreamed of, but I feel more at peace with how I’m envisioning my future self and honoring the process.

Don’t get me wrong, I still spend many days thinking I’m so behind and that I’m not disciplined enough with my time or mindful with my energy. But it’s never an all or nothing situation and spending more time recalibrating will prevent you from creating the mess you need. That mess is what will help you find creative clarity.

My biggest lesson from this past year is to go into everything with zero expectations and continue being messy.

As always, here are some ways you can make my day:

🤝 intros to your besties in DC

😇 intros to your fave female investors and founders challenging the status quo

🏅 engage and share all my Olympics content

It’s our first VC feature! Excited for y’all to meet Shreya because she’s was so thoughtful and honest in the convo. She broke down VC in such a comprehensible way. And my fave part is she’s a creative at heart. She’s a baker!

Can you give a quick intro about yourself, what you do, and what Smash Capital is?

Absolutely! My name is Shreya and I work as an investor at Smash Capital. We are a VC fund investing $10M - $250M+ checks into software and consumer internet companies at the Series B to pre-IPO stages. My role involves sourcing and conducting diligence on new investments.

If you were asked to explain venture capital and your job to a 10 year old, what would you say?

We find new businesses and give them money so they can grow really big - in exchange, we get to own a small part. It’s like if you had a lemonade stand and I gave you some money to make it bigger - you could buy more lemons, make cool signs to attract new customers, even open up a second stand. You’d use the money to grow bigger and bigger, and in exchange, give me a portion of the business.

Who is a female investor that you really admire and why? Are there any habits, mindsets, or lessons from them that you've incorporated into your life?

Sarah Tavel of Benchmark. I could listen to her talk all day. One of my favorite quotes by her is actually advice she gives to founders, which is to "convince yourself first that this is something you want to spend the next 10 years of your life on." But for me, this rings true in an investing context as well. Our mission at Smash is to back founders building category-defining, generational technology companies. When we partner with founders, we are looking at a long-term partnership that hinges on trust and commitment. This has become core to my mindset as an investor.

What's a female founded brand that you think is going to make it big but most people probably don't know about?

I have two but I think everyone knows about them at this point. The first, on the B2B side, is Deel. If you're in the SaaS community, you know that Deel is one of the fastest growing startups of all time (it took them 5 years to reach $500M in ARR where it takes the median startup 33 months to reach $1M in ARR). What more people probably don't know about Deel is that it was co-founded by Shuo Wang, a Chinese immigrant who came to the US when she was 16. Shuo's first job was selling scooters at her local flea market. What I love most about her and her founding story is how much of her success with Deel she attributes to her international background. She embodies a modern take on the "American Dream" in my opinion and her story is a testament to the contributions of immigrants to our economy.

On the consumer side, a personal favorite of mine is Partiful, which was founded by an amazing woman that is also named Shreya. This is a company that truly has its finger on the pulse of Gen Z (although I’ve somehow gotten my middle aged Indian mother to use it for invites to her pujas and she loves it too). The platform has gotten many things right - they went after an opportunity that’s been overlooked by incumbents for years, created a solution that has network effects inherently built into it, bypassed consumer app fatigue by starting off SMS-based, implemented gen AI in a way that actually enhances the user experience (cough cough, Instagram - please stop redirecting me to MetaAI when I’m trying to search for memes), and the app is just plain fun to use at the end of the day. I’m excited to continue following the team, especially as they continue building out monetization, I really do believe the sky's the limit for a company like that.

"brat summer," i whisper as i rsvp Maybe to every event

— Partiful (@partiful)

5:35 PM • Jul 24, 2024

HOTTEST INDUSTRY TRENDS

What industries/sectors are you most bullish on right now? What problems within these spaces are you really interested in and why?

We are in such a unique point in history right now, especially as a junior VC. Many of us Gen-Z and younger millennial VCs were not there to witness the breakthroughs in technology, like the creation of the internet for example, that produced what we now know to be some of the largest companies in the world.

My dad is a huge tech nerd - the type to watch algorithmic trading videos on the treadmill - so I feel like I’ve heard about AI for literally decades now. But last year, with the release of ChatGPT, the applications of AI suddenly became very tangible, especially from a consumer perspective. It was almost like this societal awakening of "oh this thing we’ve heard so much about that’s supposedly gonna change the world, and also could potentially take over the world?, has suddenly become very real."

From a VC perspective, we’ve been doing a lot of work in filtering through the noise and hype. We’ve been particularly trying to explore B2B applications of AI and what the first wave of that will look like. Then it becomes a question of which companies are in the early innings of something truly generational versus those that are putting a wrapper on ChatGPT and riding the wave.

But broadly, I’m most excited about:

Vertical AI solutions - Vertical AI solutions are exciting because they use hard-to-access proprietary data sets in order to address industry-specific challenges. Healthcare in particular stands out as an area ripe for disruption (we just invested in Pearl) due to the massive and complex datasets, intricate decision-making processes, and significant barriers to entry, which creates a competitive edge for those that are able to break through. These solutions also benefit nicely from some of the same advantages that vertical SaaS players have (strong LTV / CACs, high retention, winner takes all / most market dynamics)

Founders with domain expertise - Penetrating the enterprise tech stack is no easy feat. Trust is crucial to AI adoption so founders with a deep understanding of regulation, existing tooling, sector specific challenges, etc… are better positioned to achieve widespread distribution first.

Product roadmaps with defensibility - AI tools that address a specific pain point can be a great wedge into a new market but are not enough to be sustaining businesses. The real defensibility comes from deep integrations and workflows built around AI-powered solutions that create switching costs for customers and keep retention high.

What do you read, listen, and watch on a weekly basis to stay up to date on what's going on within the broader markets you're trying to keep a pulse on?

TechCrunch, Wall Street Journal, Axios, StrictlyVC, Launch Ticker, Morning Brew, etc… and talking to experts in the spaces I’m most excited about (whether that’s founders, thought leaders, or fellow investors).

VC MYTHS

What are the biggest myths you had about VC before starting?

I don’t think this was a myth more so than just a realization that you’re saying no more than you’re saying yes. When you’re on the outside looking into this industry, you’re most likely only hearing about the wins - the Amazons, Facebooks, Ubers, etc… of the world. But so much of being a good investor is knowing the ways in which a startup can succeed and fail. Knowing when to say “no” or even “not right now” is a crucial skill that I underestimated prior to joining.

What do you wish more people (not in VC - from the outside looking in) knew about working in VC?

People ask me for stock market advice - I’m not your girl! :)

What's one thing you would like to change/evolve about the broader VC space?

I really hope to see more people that look like me in this space, especially in software investing.

GROWTH STAGE INVESTING 101

What are the differences in early stage investing (pre-seed to Series A) vs. Series A+? What are you looking to underwrite as an investor at the growth stage across fintech, consumer tech, health tech, etc. (feel free to just pick one sector to help explain this)?

As growth equity investors, we are underwriting billion dollar plus outcomes. The only way for the economics to make sense at the stage and check size at which we enter is to believe that the company has a path to an outcome of that scale. On a more granular level, the things we’re asking ourselves are: is this company in a market that’s even big enough to produce such an outcome? Does this company have long-term profit potential? Is it both retaining its existing customers and onboarding new customers at a sustainable yet exciting momentum? Is this the right team to ~take this to the moon, as they say?

Fortunately, at our stage, there is likely enough data for us to conduct the appropriate analyses to answer a lot of these questions. But fundamentally, we are trying to back founders that have the vision to build generational, category leading companies in their respective markets.

Were there any other resources/courses you took to get smart about early-stage and growth stage investing? If so, which ones do you recommend?

You can start with newsletters like TechCrunch, Strictly VC, Launch Ticker, etc… but honestly the best way to do it is by talking to people in the space!

BREAKING INTO VC

How did you break into VC? If you could only give one piece of advice for someone looking to break into VC, what would you tell them?

I spent the beginning of my career in investment banking, which gave me a strong technical foundation for investing, but there is no one path into VC (which is something I love about it, you end up meeting people with very diverse work backgrounds). My advice for breaking in is to have perspective. Your reading, prior work, unique life experiences, and interests can contribute greatly to a strong investment thesis - are you a runner that just found an amazing new running app that you and your friends use religiously? Does your parent own a small business that just began utilizing a new tool to automate accounting workflows? Do you work for a tech company that just onboarded a new software that’s made your life much easier? Is there a company you read about on TechCrunch that has early signals of growth or traction? Those are good places to start. You’ll want to think through the key trends impacting the space, competitive landscape and who else is out there solving the same problem, market size and history, etc… as you begin forming a thesis.

How important do you think it is for folks looking to break in to have a personal brand, unique investment thesis, angel portfolio (or shadow portfolio), or any other qualifications to actually do the job?

I think perspective is the most important thing and that too a specific one. If I ask you about a trend you’re interested in and you say “AI”, it’s too broad!

What are your favorite inclusive VC communities that have helped you find friends and mentors in the space?

One of my friends at Alpha Partners, Zoe van den Bol, has created an amazing community of women in VC through her organization, Capital Supper Club. She hosts a monthly dinner for women in the space to connect over a delicious home-cooked meal. I’ve already met some incredible women through the network so if you’re a woman in VC, you should totally check it out.

GET TO KNOW SHREYA

What are you doing to fill your cup right now?

During my “5 to 9” as I call it, I run a small home bakery making cakes. I love baking and decorating cakes. Taking a step back from work to follow a passion of mine for no reason other than just the pure love of it has been so fun. If you need a cake, you know where to find me! @girlwhobakesnyc

What's a trend (can be VC/startup specific, on social media, or just in general) that you think is overrated, one that you wish would have a resurgence, or one that you would want everyone to follow?

Overrated: NFTs.

A Trend I Wish Would Have a Resurgence: Long-form content, although I don’t think it will. This is more of my broader concern for society’s quickly depleting attention span. I'm very much guilty of this (all my podcasts, audiobooks are on 2x speed).

A Trend Everyone Should Follow: Manifestation. It works.

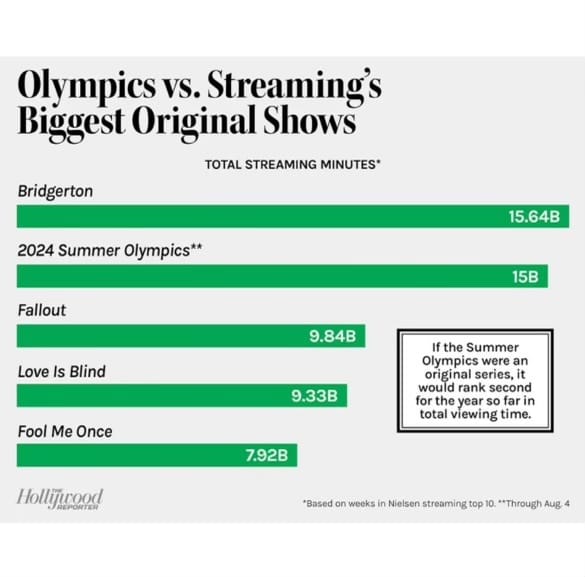

I became a US nationalist for 16 days and honestly I think the Olympics could become a true unifier….

if they figure out how to not get cities into debt, work towards real gender equity instead of banning athletes from wearing the hijab or letting a women being bullied for being a man when she clearly is not, improve the living conditions at the Olympic village, continue supporting athletes who are refugees, and paying athletes what they deserve…

Here’s everything you need to remember about the 2024 Paris Olympics:

@nbcolympics Tara Davis-Woodhall’s biggest fan. #ParisOlympics @Tara @Hunter Woodhall

@TeamUSA ONLY pays $37,500 in bonuses for a gold medal, $22,500 for a silver medal, & $15K for a bronze medal. Maher is likely walking away with multiple brand sponsorships & successful launch of her athlete-focused skincare brand Medalist Skin because of these viral moments;

— Sri Varre (@sri_varre)

3:30 AM • Aug 2, 2024

@yahoosports The Refugee Olympic team represents the hopes and dreams of refugees around the world 👏 #olympics #olympicgames #parisolympics

Picking "winners" as a VC is cool and all but getting a gold medal at the Olympics is what builds real grit, perseverance, and elite status. These are the female athletes that made history in week 1 of the Paris 2024 @Olympics :

— Sri Varre (@sri_varre)

1:36 PM • Aug 7, 2024

@nbcsports This will be the best thing you watch all day. 😂 #usa #snoopdogg #badminton #funny #commentary

- The highest-paid USA athletes at the Olympics:

- Lebron James (only billionaire competing at the Olympics): $128.2M

- Coco Gauff: $21.7M

- Nelly Gorda: $8.2M

- Simone Biles (less than $100K from gymnastics): $7M

- Trinity Rodman: $2.3M— Sri Varre (@sri_varre)

3:33 AM • Jul 30, 2024

@crutches_and_spice People have been asking about this video in light of #imanekhelif and her knockout performance at the #parisolympics. This is a repost fro... See more

"It Takes Heart to Build Bodies that Break Records"

@wearfigs (the first-ever company led by two female founders Trina Spear and Heather Hasson to go public) may just have won the best advertising opportunity at the 2024 Paris Olympics.

— Sri Varre (@sri_varre)

11:31 PM • Jul 31, 2024

Wanna be besties?

Email me at [email protected]

Follow me on Linkedln

Follow me on Twitter

Follow me on Instagram